New York City is a big deal for money stuff, especially for hedge funds. These special investment groups handle a lot of money and try to make even more for their rich clients. We’re going to look at some of the biggest hedge funds in New York City and see what makes them tick. It’s pretty interesting how they work and what they do in the financial world.

Key Takeaways

- New York City is a major center for big hedge funds.

- Hedge funds have a big impact on the financial market.

- These funds use different plans to invest money.

- Being in New York City helps these funds find good people and new ideas.

- Big hedge funds face challenges but also find new chances to grow and change with the times.

Understanding the Landscape of New York City’s Hedge Funds

Defining Hedge Funds and Their Role in Finance

Hedge funds are private investment vehicles that pool capital from accredited investors and institutions. They employ a variety of complex strategies to generate high returns, often using leverage and derivatives. Unlike traditional mutual funds, hedge funds have more flexibility in their investment choices and are subject to less regulation. Their primary goal is to maximize investor returns, regardless of market conditions, by taking both long and short positions. This means they can profit when asset prices rise or fall. They typically charge a management fee, often 2% of assets under management, and a performance fee, usually 20% of profits, known as "2 and 20."

The Unique Ecosystem of New York City’s Financial Sector

New York City stands as a global financial hub, and its ecosystem provides a unique environment for hedge funds. The city offers unparalleled access to financial markets, a vast pool of skilled professionals, and a dense network of financial institutions. This concentration of resources creates a competitive yet collaborative atmosphere. The proximity to major exchanges, investment banks, and regulatory bodies allows for quick information flow and efficient execution of trades. The city’s infrastructure, from technology to legal services, also supports the complex operations of these funds. For those looking to understand the differences between various financial entities, exploring hedge fund vs asset management can provide valuable insights.

Key Characteristics of Leading Hedge Funds

Leading hedge funds in New York City share several common characteristics that contribute to their success. These include:

- Sophisticated Investment Strategies: They utilize advanced quantitative models, fundamental analysis, and macroeconomic insights to identify opportunities.

- Experienced Management Teams: Their leadership often comprises individuals with decades of experience in finance, economics, and specific market sectors.

- Robust Risk Management Frameworks: Given the complex and often leveraged nature of their investments, strong risk controls are essential to protect capital.

- Access to Proprietary Data and Technology: Many top funds invest heavily in technology and data analytics to gain an edge in information processing and trade execution.

- Strong Investor Relations: Maintaining trust and transparency with their limited partners is vital for capital retention and future fundraising.

The operational framework of a hedge fund is built on a foundation of strategic agility and a relentless pursuit of alpha, which is the excess return of an investment relative to the return of a benchmark index. This pursuit often involves unconventional methods and a willingness to deviate from traditional investment norms. The ability to adapt quickly to market shifts and capitalize on inefficiencies is a hallmark of successful funds.

For more information on the broader financial landscape, you might find this page helpful.

Identifying the Largest Hedge Funds in New York City

Criteria for Ranking Top Hedge Funds

Determining the largest hedge funds in New York City involves looking at several factors beyond just assets under management (AUM). While AUM is a primary indicator, other elements provide a more complete picture of a fund’s standing and influence. These include:

- Investment Performance: Consistent, strong returns over various market cycles.

- Longevity and Stability: How long the fund has been operating and its ability to weather economic downturns.

- Reputation and Influence: The fund’s standing within the financial community and its impact on market trends.

- Breadth of Strategies: The diversity of investment approaches employed, indicating adaptability.

A fund’s size often correlates with its ability to access unique investment opportunities and attract top talent, but it does not automatically guarantee superior returns. The true measure of a fund’s success lies in its consistent ability to generate alpha for its investors, regardless of market conditions.

Prominent Names and Their Investment Philosophies

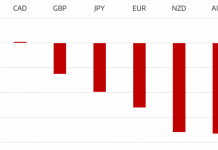

New York City is home to many of the world’s most significant hedge funds, each with distinct investment philosophies. These firms often specialize in particular strategies or asset classes. For example, some focus on global macro trends, making bets on interest rates, currencies, and commodities. Others might employ equity long/short strategies, aiming to profit from both rising and falling stock prices. Understanding the core investment philosophy of these firms is key to appreciating their market impact. Many of these richest hedge funds have founders who are well-known figures in finance, and their personal investment beliefs often shape the fund’s overall approach.

Impact of Fund Size on Market Influence

The size of a hedge fund in New York City directly affects its market influence. Larger funds can deploy significant capital, which can move markets, especially in less liquid assets. Their trading activities can create trends or amplify existing ones. Furthermore, large funds often have access to proprietary research, advanced technology, and a vast network of industry contacts, giving them an edge. Their sheer scale also allows them to negotiate better terms with brokers and counterparties. This influence extends beyond just trading; large funds often play a role in shaping regulatory discussions and industry standards. The rise of digital assets, for example, has seen some of these larger funds begin to explore cryptocurrency investments, further expanding their reach.

Investment Strategies Employed by Major NYC Hedge Funds

Diversified Approaches to Capital Allocation

Large hedge funds in New York City use many ways to put their money to work. They don’t just stick to one type of investment. Instead, they spread their money across different areas like stocks, bonds, currencies, and even private companies. This helps them manage risk and try to get good returns no matter what the market is doing. Some funds might focus on global macro strategies, making bets on big economic trends. Others might use long/short equity, buying stocks they think will go up and selling ones they think will go down. There are also funds that specialize in distressed debt, buying up loans from companies that are struggling, hoping to profit when things turn around. The goal is always to find opportunities that fit their specific risk tolerance and return targets. For more information on how these funds operate, you can explore various New York hedge funds.

Risk Management and Performance Metrics

Managing risk is a big deal for these funds. They have whole teams dedicated to it. They use complex models to figure out how much risk they’re taking on and how different investments might affect each other. It’s not just about making money; it’s about not losing too much when things go wrong. They look at things like Value at Risk (VaR), which estimates potential losses, and stress testing, which simulates extreme market conditions. Performance is measured in many ways, not just by how much money they make. They also look at Sharpe ratios, which show return per unit of risk, and alpha, which measures how much they outperform a benchmark. These metrics are key for showing investors how well the fund is doing relative to the risks it takes.

Hedge funds in New York City are always looking for an edge. They spend a lot of time and money on research, trying to find unique insights that others might miss. This constant search for information helps them make better decisions and stay ahead in a very competitive environment. They also invest heavily in technology to process data and execute trades quickly.

Adaptability in Evolving Market Conditions

The financial world changes all the time, and these big hedge funds have to change with it. They can’t just stick to one strategy forever. When new technologies come out, or when global events shift the economy, they have to adjust. For example, if interest rates go up, they might change their bond strategies. If a new industry emerges, they might start looking for investment opportunities there. This means their investment teams are always learning and looking for new ways to make money. They might even shift their focus to different regions, like exploring the Dallas investment landscape, if they see better opportunities there. This flexibility is a big reason why they can stay successful over time.

- Regularly review and update investment models.

- Monitor global economic and political developments closely.

- Allocate resources to research emerging markets and technologies.

- Adjust portfolio allocations based on changing market sentiment.

- Maintain open communication channels with industry experts and analysts.

The Influence of New York City’s Financial Hub

New York City’s role as a global financial center significantly shapes the hedge fund industry. The city provides a unique environment that supports the growth and operation of these funds, offering advantages not found elsewhere. This environment helps hedge funds attract top talent, navigate regulations, and adopt new technologies.

Talent Acquisition and Industry Networking

New York City is a magnet for financial professionals. The concentration of investment banks, private equity firms, and other financial institutions creates a deep pool of skilled individuals. Hedge funds in NYC benefit from this, as they can recruit from a diverse range of backgrounds, including quantitative analysts, portfolio managers, and risk specialists. The city’s financial ecosystem also promotes extensive networking opportunities, allowing professionals to connect, share insights, and identify new business ventures. This constant exchange of ideas and talent helps funds stay competitive and innovative.

- Access to top-tier universities and business schools.

- High concentration of experienced financial professionals.

- Frequent industry conferences and events.

Regulatory Environment and Compliance

The regulatory landscape in New York City, and by extension the United States, is complex and constantly evolving. Hedge funds operating here must adhere to strict rules set by bodies like the SEC (Securities and Exchange Commission) and FINRA (Financial Industry Regulatory Authority). While this can be challenging, it also provides a framework that promotes transparency and investor protection. The presence of numerous legal and compliance firms specializing in financial regulations helps funds manage these requirements. This structured environment, though demanding, contributes to the credibility and stability of the NYC hedge fund sector. San Francisco’s biggest hedge funds also operate within a similar regulatory framework.

The regulatory environment, while strict, helps maintain trust in the financial system. Funds that successfully navigate these rules often gain a reputation for reliability, which can attract more investors. This balance between oversight and operational freedom is a key aspect of the city’s financial appeal.

Technological Advancements Driving Innovation

Technology plays a big part in how hedge funds operate today. New York City is a hub for financial technology (fintech) innovation, with many startups and established tech companies focusing on solutions for the financial sector. Hedge funds use these technologies for things like:

- Algorithmic trading: Using computer programs to execute trades at high speeds.

- Data analytics: Processing large amounts of market data to find investment opportunities.

- Cybersecurity: Protecting sensitive financial information from threats.

This focus on technology helps funds improve their performance and manage risks more effectively. The city’s push to become a smarter city also supports this technological growth, creating an environment where innovation can thrive.

Challenges and Opportunities for Large Hedge Funds

Navigating Market Volatility and Economic Shifts

Large hedge funds in New York City face a constant battle with market ups and downs. It’s not just about picking good stocks; it’s about understanding big economic changes and how they might affect everything. Think about interest rates going up or down, or big global events like trade disputes. These things can really shake up markets, and hedge funds have to be ready to adjust their plans quickly. They need to have solid ways to deal with risk, so they don’t lose a lot of money when things get rough. It’s like trying to steer a big ship through a storm—you need good instruments and a steady hand. Sometimes, they might even see chances to make money when others are panicking, which is a unique skill.

Attracting and Retaining Top Investment Talent

Getting and keeping the best people is a huge deal for these funds. New York City is full of smart finance folks, but everyone wants the absolute best. These funds need people who are not just good at numbers but also creative thinkers and problem-solvers. It’s a really competitive environment. They offer big salaries and bonuses, sure, but they also need to create a place where people feel challenged and can grow their careers. If they can’t get the right talent, it’s hard to stay ahead of the game. It’s a constant effort to find and keep those sharp minds who can spot the next big investment idea or manage complex portfolios. Investment management operations are only as good as the people running them.

Embracing Sustainable and Responsible Investing

More and more, investors care about where their money goes, not just how much it makes. This means large hedge funds are under pressure to think about things like environmental impact, social fairness, and good company management. It’s not just a nice-to-have anymore; it’s becoming a must-have. They have to look at companies not just for their profits but also for how they treat their workers, their carbon footprint, and if their leaders are ethical. This can be a challenge because it adds another layer of complexity to their investment decisions. But it’s also an opportunity to attract new investors who prioritize these values. It’s a shift in how they think about what makes a good investment, moving beyond just financial returns. Regulatory changes are also pushing this forward.

The financial world is always changing, and large hedge funds have to be quick on their feet. They need to be smart about how they invest, how they manage risk, and who they hire. Plus, they have to keep up with what investors care about, like being responsible with their money. It’s a lot to juggle, but if they do it well, they can keep growing and stay at the top of the game.

Future Outlook for New York City’s Hedge Fund Industry

Emerging Trends in Alternative Investments

The hedge fund industry in New York City is always changing, with new investment types appearing. We are seeing more interest in things like private credit and infrastructure. These areas can give different returns than traditional stocks and bonds. Also, there’s a growing focus on digital assets. Many funds are looking at how to include cryptocurrencies and blockchain technology in their plans. This shift means funds need to learn new things and understand different kinds of risks.

The move towards alternative investments shows that hedge funds are trying to find new ways to make money. They are also trying to spread out their risks. This is important as traditional markets can be unpredictable. Funds are looking for stability and growth in less common places.

The Role of Technology in Fund Management

Technology is changing how hedge funds work. Artificial intelligence (AI) and machine learning (ML) are becoming very important. These tools help funds analyze huge amounts of data quickly. They can also help find new trading ideas and manage risks better. Automation is also a big deal, making many daily tasks faster and more accurate. This lets fund managers focus on bigger decisions.

- AI for predictive analytics

- Machine learning for pattern recognition

- Automated trading systems

- Big data processing

- Cybersecurity for data protection

Sustaining Growth in a Competitive Landscape

New York City’s hedge fund scene is very competitive. To keep growing, funds need to be smart. They have to attract and keep good people. They also need to find new ways to invest and manage money. Being able to change quickly to new market conditions is key. Funds that can do this will likely do well in the future. The future of finance will be shaped by these changes. The hedge fund industry is always evolving.

| Year | New Fund Launches (NYC) | Total Assets Under Management (NYC, in Trillions USD) |

|---|---|---|

| 2023 | 120 | 2.8 |

| 2024 | 115 | 3.0 |

| 2025 | 130 | 3.2 |

Conclusion

So, we’ve looked at some of the big hedge funds in New York City. It’s clear these places are a big part of the financial world. They do a lot of different things, and they have a lot of money. It’s pretty interesting to see how they work and what makes them tick. Understanding these firms helps us get a better idea of how the whole financial system operates. They really are a key part of the city’s economy, and they keep things moving in the investment space.

Frequently Asked Questions

What exactly is a hedge fund?

Hedge funds are special investment groups that gather money from many different people or companies. They then use this money to make various kinds of investments, hoping to earn a lot of money for their clients. Think of them like a big, smart piggy bank that tries to grow your savings using clever strategies.

Why are so many big hedge funds in New York City?

New York City is a huge money center, like the heart of the finance world. It has tons of smart people, big banks, and lots of information flowing around. This makes it a perfect spot for hedge funds to set up shop because they need all these things to do their best work.

How do you figure out which hedge funds are the biggest?

We look at a few things, like how much money they manage (the more, the bigger!), how well they’ve made money for their clients over time, and what kind of special ways they invest. It’s like picking the best team based on their wins and how they play the game.

What kinds of investment tricks do these big funds use?

Large hedge funds use many different ways to invest. Some might buy and sell stocks quickly, others might invest in big companies, and some might even bet on things like how much oil costs. They spread their money around to lower risk and try to find the best chances to make money.

How does a hedge fund’s size affect the money world?

Being big means they have a lot of power in the market. When they buy or sell a lot of something, it can make the price go up or down. They can also get special deals and have more resources to find the best investments. It’s like being a giant in a small pond – your moves make bigger waves.

What’s next for big hedge funds in New York City?

The future looks exciting! We might see more funds using computers and smart programs to make investment choices. Also, there’s a growing interest in investing in companies that are good for the planet and society, not just those that make a lot of money.

Peyman Khosravani is a global blockchain and digital transformation expert with a passion for marketing, futuristic ideas, analytics insights, startup businesses, and effective communications. He has extensive experience in blockchain and DeFi projects and is committed to using technology to bring justice and fairness to society and promote freedom. Peyman has worked with international organizations to improve digital transformation strategies and data-gathering strategies that help identify customer touchpoints and sources of data that tell the story of what is happening. With his expertise in blockchain, digital transformation, marketing, analytics insights, startup businesses, and effective communications, Peyman is dedicated to helping businesses succeed in the digital age. He believes that technology can be used as a tool for positive change in the world.